Section PF.6 - Income Tax Decisions

| Taxes Withheld by the Employer |

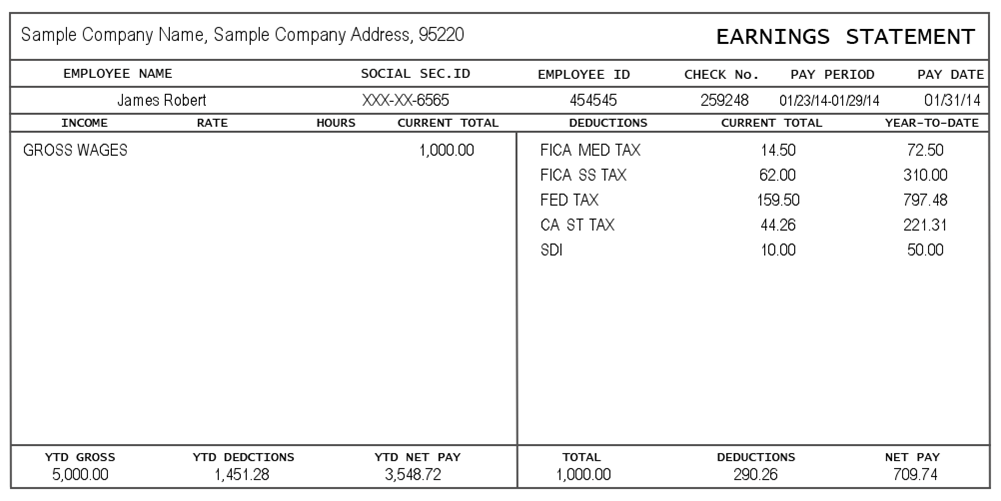

When an employee’s wages are computed, gross pay is the total before any deductions or withholdings occur. The final total of the gross pay minus all the withholding and deductions is known as net pay or take-home pay, and this amount is immediately available to the employee.

Based on information given to the employer on the W4, employers will earmark a certain percentage of the gross amount to be withheld for the government to account for federal taxes. This withholding is given as a tax payment to the government as the year progresses and forms a portion of the income tax that will be due for the year. FICA, or Federal Insurance Contributions Act, is money taken that is used for the Social Security and Medicare programs that most Americans are eligible for at retirement. Social Security provides payments to eligible retirees, people with health problems, eligible dependents of deceased person, and disabled citizens. Medicare provides health care coverage mostly to Americans 65 and older.

In 2023, FICA is approximately 7.65% of gross income, which is matched by the employer and goes into these social programs to be tapped later. States can also withhold funds from gross paychecks to cover state income tax for the year. The amount withheld is dictated by the W4, and the percentage in 2023 for Arizona was 2.5%. Each state has their own unique amount of state tax levied, and some states have no state income tax at all. Taxes are not the only thing deducted from gross earnings. Healthcare benefits, insurance, voluntary contributions, and retirement savings may also be subtracted from the gross amount.

| Example 1 |

| Mohamed would like to have extra spending money, so he decides to work part-time at Jimmy John’s. The job pays $15.25 per hour and he works 25 hours per week. His employer withholds 9.5% of his gross pay for federal taxes, 7.65% for FICA taxes, and 2.75% for state taxes.

a. What is his weekly gross pay? b. How much is withheld per week for federal taxes? c. How much is withheld per week for FICA taxes? d. How much is withheld per week for state taxes? e. What is his weekly net pay? f. What percentage of his gross pay is withheld for taxes? |

| a. What is his weekly gross pay?

$15.251 hour x 25hours 1 week = $381.25/week b. How much is withheld per week for federal taxes? 381.25 * 0.095 = $36.22 c. How much is withheld per week for FICA taxes? 381.25 * 0.0765 = $29.17 d. How much is withheld per week for state taxes? 381.25 * 0.275 = $10.48 e. What is his weekly net pay? 381.25 – (36.22 + 29.17 + 10.48) 381.25 – (75.87) = $305.38 f. What percentage of his gross pay is withheld for taxes? 9.5% + 7.65% + 2.75% = 19.9% or [latex]\frac{75.87}{381.25}[/latex] x 100 = 19.9% |

| You Try PF.6.A |

| Salina decides to work part-time at a child care business. The job pays $17.50 per hour and she works 30 hours per week. Her employer withholds 8.25% of her gross pay for federal taxes, 7.65% for FICA taxes, and 1.9% for state taxes.

a. What is her weekly gross pay? b. How much is withheld per week for federal taxes? c. How much is withheld per week for FICA taxes? d. How much is withheld per week for state taxes? e. What is her weekly net pay? f. What percentage of her gross pay is withheld for taxes? |

| Refund or Owe? |

In the last section, we discussed how income tax amounts were calculated. The amount owed after all calculations are made is compared to the amount, if any, that has been withheld by the employer. If the amount withheld is greater than the amount owed, then the government issues a refund of the overpayment. If the amount withheld is less than what is owed, then the taxpayer is responsible to pay the difference.

| Example 2 |

|

Marshall and Nicole are married and filing jointly. Marshall earned $48,683 and his employer withholds 11.5% of his gross pay for federal taxes. Nicole earned $47,751 and her employer withholds 9.8% for federal taxes. They calculated their federal taxes and found that they owe $8645. Do they owe more at the end of the year or get a refund? How much? |

| Marshall’s employer withholds money from his paycheck.

48,683 x 0.115 = $5598.545 Nicole’s employer withholds money from her paycheck. 47,751 x 0.098 = 4679.598 Together they have $10,278.14 withheld from their checks. They only owe $8,645, so they will get a refund of 10,278.14 – 8,645 = 1,633.143 Refund $1,633 |

| You Try PF.6.B |

| Noah is employed as a bailiff in Maricopa County. He earned $51,962 last year. His employer withheld 11.6% of his gross pay for federal taxes. Noah calculated his federal taxes and found that he owes $6,582. Will Noah owe more taxes at the end of the year or get a refund? How much? |

| Change To Take-Home Pay Following a Tax-Deferred Contribution |

If a taxpayer elects to have contributions taken from their pay pre-tax, then this will affect the net pay or take-home pay. For example, if someone contributes to an IRA or 401K, then the money is subtracted from their gross pay and will thus reduce the taxable income. This means a tax-deferred contribution of $100 will not cause your net pay for the year to go down by a $100. Consider the scenarios for the taxpayer below:

Scenario 1: Adam has a taxable income of $30,000. His income tax for the year is calculated as follows using the sample tax rates table:

Income Tax for the Year = 0.10*$11,000+0.12*$19,000 = $3380

Which means Adam’s take-home pay for the year is $30,000 - $3,380 = $26,620

Scenario 2: Terri has a taxable income of $30,000. She makes a $100 monthly tax-deferred contribution. Her income tax for the year is calculated as follows using the sample tax rates table:

Total tax-deferred contribution = 12*$100 = $1,200

Taxable Income = $30,000 – ($1,200) = $28,800

Income Tax for the Year = 0.10*$11,000+0.12*$17,800 = $3,236

Which means Terri’s take-home pay for the year is $30,000 - $1,200 - $3,236 = $25,564

Terri and Adam started with the same taxable income. Terri made a $1,200 tax-deferred contribution but her annual take-home pay only decreased by $1,056 compared to Adam’s annual take-home page, $1,056 = $26,620-$25,564. We would say that Terri’s contribution created a $144 tax savings, $144 = $1,200 - $1,056.

When the marginal tax rate doesn’t change, there is a much shorter way to calculate the decrease in annual pay and the tax savings.

Tax Savings = 0.12*$1,200 = $144

Decrease in Take Home Pay for a $1,200 tax-deferred contribution = $1,200 - $144 = $1,056

The above scenarios did not consider other taxes such as payroll/state income tax or that a contribution might change a taxpayer’s marginal tax rate. However, the calculation still gives you a good idea of how your annual take-home pay is affected by tax-deferred contributions.

| Example 3 |

|

Calculate the change in annual take-home pay when the following tax-deferred contributions are made. Assume the marginal tax rate does not change due to the tax-deferred contributions. You are married filing separately and have a taxable income of $32,700. You make monthly contributions of $200 to a tax-deferred saving plan. |

|

Your annual contribution is a total of $200 * 12 = $2,400 $32,700 is in the 12% tax bracket. Change 12% into a decimal and multiply it by the $2,400 tax-deferred contribution. 0.12($2,400) =$288 Subtract this amount from $2,400. $2,400 – $288 = $2,112. Your annual take-home pay decreases by $2,112 rather than by the $2,400 you contributed in total. |

|

You Try PF.6.C |

|

Calculate the change in annual take-home pay when the following tax-deferred contributions are made. Assume the marginal tax rate does not change due to the tax-deferred contributions. You are filing head of household and have a taxable income of $197,545. You make monthly contributions of $500 to a tax-deferred saving plan. |

| Tax Deduction vs Tax Credit |

The difference between a tax deduction and a tax credit is when the money is subtracted. Deductions reduce the taxable income amount, while credits reduce the actual tax amount owed. Therefore, deductions have a lesser impact on the bottom line since they affect the amount on which the tax is calculated, rather than the tax owed. For example, a $1000 deduction will reduce taxable income by that amount, assuming itemized deduction, and the tax saved will depend on the tax rates table. If the deduction does not change their marginal tax rate, due to a lower taxable income, then the tax savings is easy to calculate. If the person’s marginal tax rate is 20%, they will save $200 (20% of the $1000 deduction).

A tax credit of $1000 will save the full amount on their total taxes for the year, regardless of their marginal tax rate.

| Example 4 |

|

Suppose your marginal tax rate is 37%. Assume the marginal tax rate does not change due to the tax deductions. a. How much does a $1500 charitable contribution (which is tax deductible) save you? Answer for both the case in which you itemize deductions and for the case in which you take the standard deduction. b. How much does a $1500 tax credit save you? Answer for both the case in which you itemize deductions and for the case in which you take the standard deduction. |

| a. Charitable contribution

Itemized Deduction. 0.37(1500) = 555 Itemized will save you $555 because of a reduced taxable income. Standard Deduction will save you nothing because the standard deduction covers all amounts. b. Tax Credit Since credits reduce the amount of the tax owed, there is no impact whichever deduction (standard or itemized) is taken. Itemized will save you $1500. Standard will save you $1500. |

| You Try PF.6.D |

|

Suppose your marginal tax rate is 24%. Assume the marginal tax rate does not change due to the tax deductions. a. How much does a $700 charitable contribution (which is tax deductible) save you? Answer for both the case in which you itemize deductions and for the case in which you take the standard deduction. b. How much does a $700 tax credit save you? Answer for both the case in which you itemize deductions and for the case in which you take the standard deduction. |

| True Cost of Charitable Donation |

As previously discussed, taxpayers can elect to itemize deductions to reduce taxable income. Charitable donations will reduce this amount, and thus offer extra dollars to the charity. For example, any money offered to charity will be subsidized by the amount of tax that would have been assessed on that amount.

| Example 5 |

|

Brynlee is in the 12% marginal tax bracket. Victor is in the 22% marginal tax bracket. They each itemize their deductions. They each donate $3000 to charity. Compare their true costs for the charitable donation. Assume the marginal tax rate does not change due to the charitable donation. |

|

Brynlee 0.12(3000) = 360 3000 – 360 = 2640 The true cost is $2640. The charity receives $3000, but the cost to Brynlee is only $2640. The difference is the amount that would have been paid in taxes on the original amount. Victor 0.22(3000) = 660 3000 – 660 = 2340 The true cost is $2340. The charity receives $3000, but the cost to Victor is only $2340. The difference is the amount that would have been paid in taxes on the original amount. |

| You Try PF.6.E |

|

Tyler is in the 24% marginal tax bracket. Monica is in the 35% marginal tax bracket. They each itemize their deductions. They each donate $4500 to charity. Compare their true costs for the charitable donation. Assume the marginal tax rate does not change due to the charitable donation. |

Section PF.6 – Answers to You Try Problems

PF.6.A

a. $525.00

b. $43.31

c. $40.16

d. $9.98

e. $431.55

f. 17.8%

PF.6.B

Owe $554

PF.6.C

Your annual take-home pay decreases by $4,080 rather than by $6,000.

PF.6.D

Charitable contribution

Itemized will save you $168.

Standard Deduction will save you nothing.

Tax Credit

Itemized will save you $700.

Standard will save you $700.

PF.6.E

Tyler’s true cost is $3420.

Monica’s true cost is $2925.